GET SMARTER ABOUT FRAUD MITIGATION

8 of the top 10 banks use Phone-Centric Identity to mitigate fraud. Do you?

Download the white paper

Learn how top companies are leveraging Phone-Centric Identity in advancing their fraud mitigation strategies.

Phone-Centric Identity is rapidly becoming the technology of choice for fraud and risk executives tasked with the challenge of authenticating and verifying their company's customers without hindering the customer experience.

Fraud professionals are choosing Phone-Centric Identity because of its ability to leverage something customers already have - a mobile phone and phone number - to prove their identity across channels such as mobile, web, call center and even in-store.

They're also finding that the unique signals delivered by the mobile phone are the best proxy for a customer's digital footprint, and enable them to reduce reliance on vulnerable identity authentication methods such as passwords and SMS OTP.

1,000+ companies and 500 banks use Prove to secure their experiences and accelerate revenue growth.

.png?width=1338&height=363&name=barclays-ar21%20(1).png)

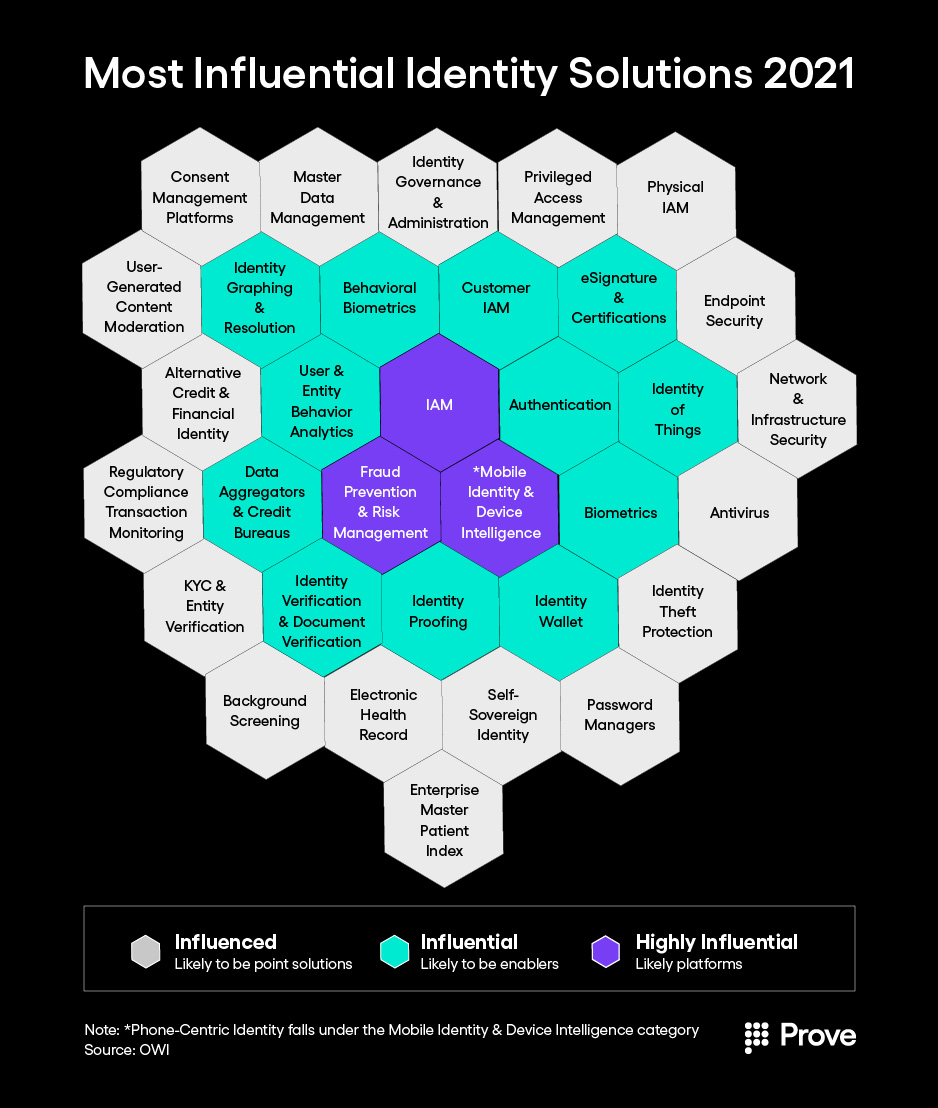

Digital identity experts at One World Identity (OWI) highlighted phone intelligence technology as highly influential in their 2021 Digital Identity Landscape report:

“Being able to rely on that device as a proxy for a human—especially a mobile device—because how many of us are attached at the hip to our smartphones all day every day?" said Cameron D’Ambrosi, Managing Director of OWI.

"In terms of the velocity of those data attributes that we’re feeding into the digital identity ecosystem...that makes this tremendously useful especially for these fraud and risk use cases.”

Are you leveraging Phone-Centric Identity to stay current and ahead of fraudsters' evolving tactics? Download our white paper above to learn more.

©2024 Payfone, Inc. DBA Prove. All Rights Reserved. Privacy Policy.